If your company needs a more agile approach, a shift in your financial governance could make all the difference. In particular, shifting from project-based funding to a product-based model may be the solution.

When enterprises adopt a minutiae-focused approach to funding, it can create bottlenecks and waste time.

Organising your work and funding decisions around value streams can significantly reduce the number of funding decisions required and the associated time and effort.

Value stream management allows you to assign budgets to customer-centric values. With this strategy, what your customers value is given priority. Instead of funding tasks and projects, you fund teams that are assigned to a key objective.

The incentive always comes back to efficiency. Align your funding with your objectives in order to achieve a faster time to market. It’s a transformative management mentality that can be applied across the entire enterprise.

In this article, we’re looking at how adjusting the funding level from projects to products can enhance the visibility and manageability of your budgets. It can also dramatically reduce the number of funding decisions required, and we will explore how this can be done later in this article.

What are the disadvantages of project-level funding approvals?

✖ Has to happen for every single project

Having to manage and base funding decisions across every single project, is not only time-consuming, it’s also not necessary.

✖ Reapprovals required as soon as any project goes outside of budgetary constraints

If you think about how many projects might end up being completed outside of the allocated budget, that results in a large number of reapprovals. This takes time and slows down progress.

✖ Inflexible when changing priorities due to siloed approach

Changing priortiies becomes a challenge as numerous approvals need to be made when reallocating budget at project level.

✖ Work stops when project ends

By the time your project is completed, the next technological breakthrough may have occurred, putting your product behind competitors. The time it takes to set up an entirely new project and get the funding approved will slow down your progress and reduce value for the customer.

How can product-based funding decisions help?

Funding hierarchy restructuring is another step in the value stream management process. It’s all about simplifying your funding and how you monitor and manage your budgets.

✓ Decrease annual planning complexity

Value streams are placed at the top of the hierarchy. Products are attached to a value stream. Then you filter down into your projects. You still track the individual projects financial performance, however, you are significantly decreasing the governance required to adapt to changes at that level.

Even large financial institutions can shift billions of dollars in investment from 900+ projects to just 10 value streams. This is a 100-fold decrease in annual planning complexity.

✓ Easier, streamlined budget management

For starters, it becomes much easier to manage and see the bigger picture. You can track the budgets that truly matter. In your current set-up, you may fund hundreds of projects. Managing funding in this way is exhausting and inefficient. Instead of funding projects, you can fund products at the value stream level. It’s much easier.

You’ll still have visibility at all levels, but you’re in control of what data you see.

✓ Manage demand and capacity more effectively

Detached from funding, epics can easily be steered across timeboxes, enabling the enterprise to manage demand and capacity effectively.

How can software help

Software can help facilitate a more agile way of managing your funding. Below, we’re outlining some of the benefits that tools such as Broadcom’s Clarity can provide.

✓ Enhanced visibility

You choose where in the hierarchy you want to manage and track the finances. You can do this at the value stream level or another level. You’ll still be able to filter visibility across all your initiatives or epics. However, by funding products at the value stream level, you will improve product visibility.

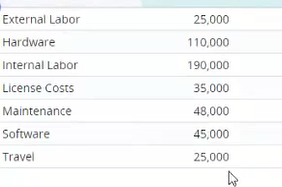

You’ll have an overarching budget attached to your values. You can also break down these costs across a fiscal period to see how they are calculated.

✓ Custom dashboards & reports

You can then create your own views and dashboards. Custom reports are a fantastic tool for seniors. Plus, these are automatically generated and use live data. You don’t need to spend weeks collecting data.

Preparing for agility

If you want to scale up your enterprise, you won’t want your PMOs to get bogged down with monitoring endless budgets and numbers. You can set the financial parameters for each level of your hierarchy and reduce the time spent on financial management at project level.

By reducing the time spent managing budgets, you can generate sustainable, long-term growth for your business.

Contact the PPM software specialists at Ignite Technology to learn more about how tools like Broadcom’s Clarity can help you manage portfolios more efficiently.